Here’s our preliminary 10/7/2023 look at recent market and portfolio results as of the end of Q3 2023, 9/30/2023. Click on the following for more detail:

Q3 O’Reilly Standard Model Portfolio Results

Q3 O’Reilly Social Model Portfolio Results

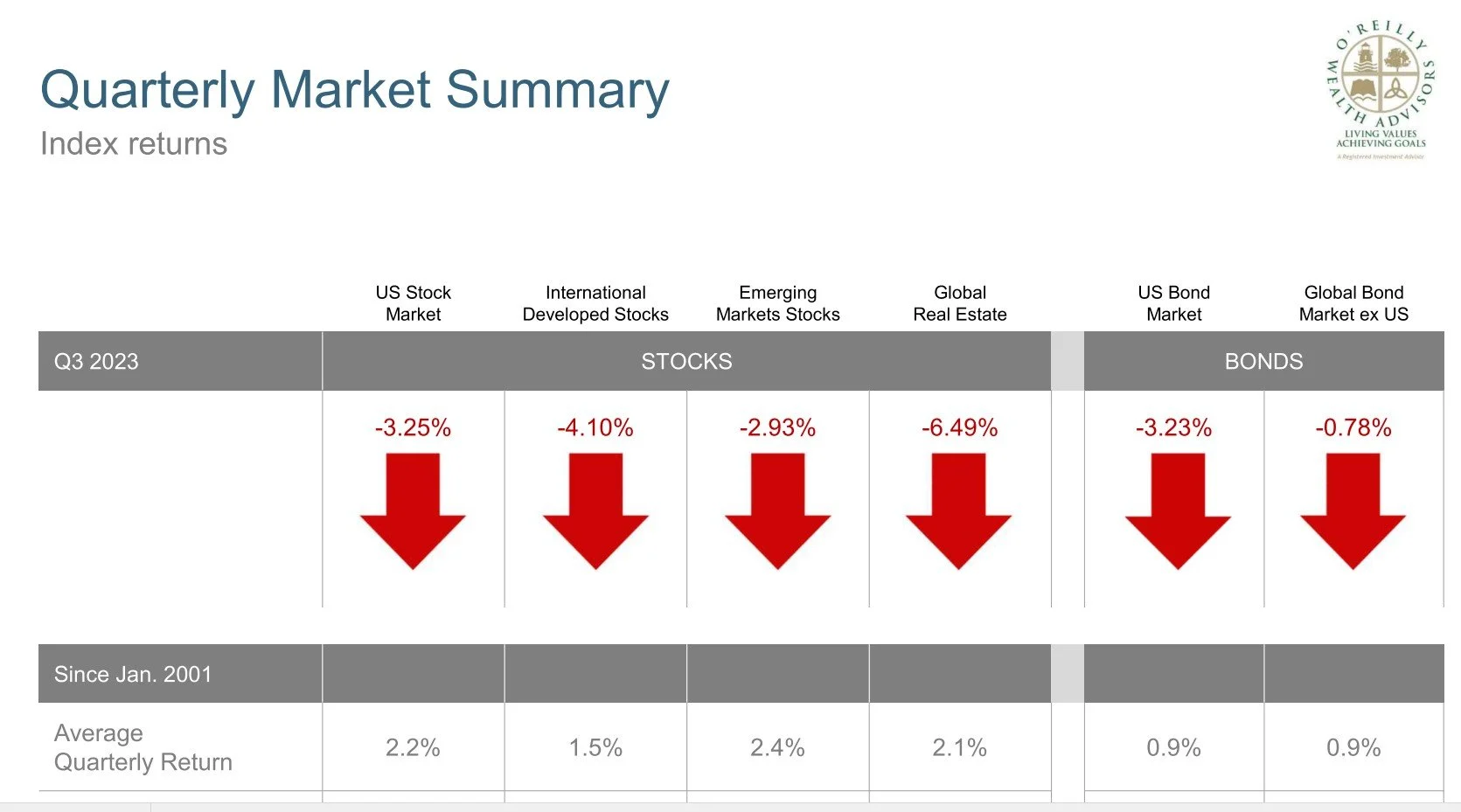

Q3 was down across most global stock and bond market segments. The tug of war between interest rate hikes, inflation control, job market health and economic activity continued. This tug of war results in the market going down when more of us take on new jobs, and then later the same day, the market moves up for a nice gain. This is the impact of market speculators that create completely unnecessary market volatility.

The “downer” is that the market moved from thinking that interest rate cuts might occur by end of 2023 or during 2024 (which is good for everyone) to assumptions that interest rate cuts are now delayed beyond that. Neither stocks nor bonds liked the idea that interest rate cuts are not on the immediate horizon.

Essentially, so far, the economy has weathered the aggressive interest rate hikes very well. GDP is positive and the job market remains strong. Meanwhile although inflation has dropped, the rate of inflation reduction slowed and the target of 2% is still far away.

In the meantime, interest rates are at a more normal long term level now which is healthy, and bonds also pay more now - also good.

If stocks report solid earnings in the next 6 weeks - that could lead to a small rally.

Though the quarter was not great in terms of performance, the last 12 months performance is excellent. Keep in mind one quarter or even one year, is like 2 minutes in a 60 minute football game. It cannot be relied upon as an indicator of the long term market expectations.