What is this number sequence?

+28.7

+10.9

+4.9

+15.8

+5.5

-37.0

+26.5

+15.1

+2.1

+16.0

+32.4

+13.7

+1.4

+12.0

+21.8

-4.4

+31.5

+18.4

+28.7

-18.1

and, finally, +9.8?

That's 20 individual years of S&P500 annual returns from 2003 to 2022. The very last number 9.8 is the total annualized return over the entire 20-year period.

In total we have 97 years of S&P500 return data (1926-2022) and the annualized return 1926-2022 is 10.1. So the last 20 year result of 9.8 is very close to the entire 97 years, and that includes both 2008’s ugly -37.0% return and last year’s uncomfortable -18.1% return.

The individual yearly returns are all over the map. Did you notice that there were no returns within 2 percent of the annualized return of 9.8? (7.8 to 11.8) They’re all over the map! This is how markets work! Returns bounce around - there’s nothing we can do about that, returns are never steady!

The -37.0% return in 2008 and the -18.1% return in 2022 are certainly numbers we dislike greatly. Yet the 9.8% return allows wealth to grow very well and includes those negative years which are impossible to know in advance.

What happened in the years after that -37% return, as awful as was all the news after the 2008-09 “Great Recession”? Look at the number sequence! There were 9 straight years of positive returns with an annualized return of 15.3% over those 9 years and a total return of 137.7%!

Many people MISSED that incredible return following 2008 because they bailed out. They either forgot about market behavior, didn’t know, or the emotion (fear) of that time period caused them to act irrationally. It affects everyone to some extent, even us. It’s natural to be concerned when markets inevitably drop even though we know it’s normal. Since we coach and teach on this topic, we can go back to our fundamental knowledge of market behavior and remind ourselves that, “This, too, shall pass!”

Success in the market requires discipline. Stick to the plan!

Even if you’re not our client, if you are ever feeling anxious about market returns, please don’t hesitate to reach out. We post numerous blog posts on this topic to help people cope with the market’s inevitable up and down behavior with the hope that fewer people will abandon a good strategy because their emotion caused them to want to take action.

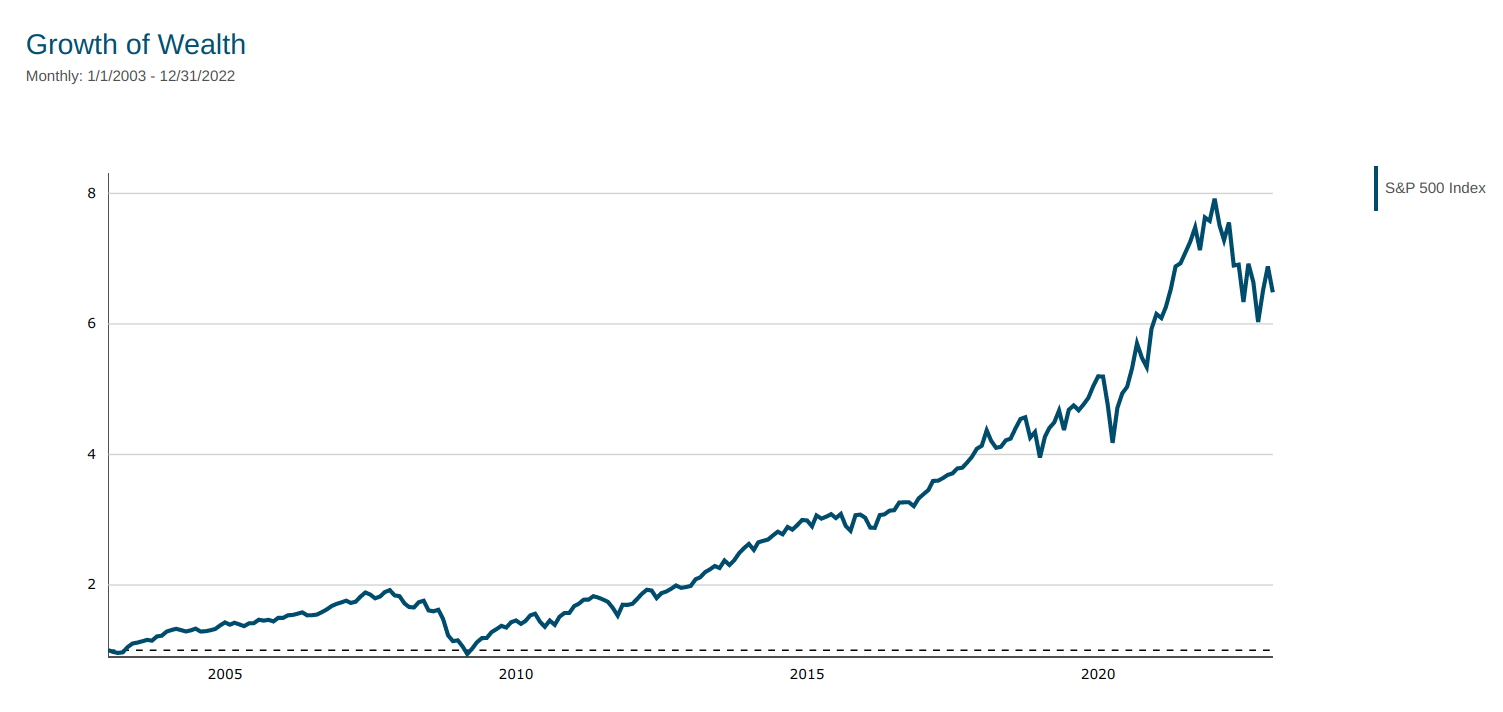

The S&P Index return 2003-2022 (a low cost index fund would have a slightly lower return), $1 grew to a little less that more than $6 over the last 20 years.